Die Kennzahl „Kurzfristiger Inhaberstress“ von Bitcoin ist auf den niedrigsten Stand seit 2018 gesunken, was darauf hindeutet, dass der Markt kapituliert und möglicherweise seinen Tiefpunkt erreicht hat.

A key Bitcoin (BTC) on-chain metric is flashing its most extreme capitulation signal since 2018, hinting at a potential cycle-low setup.

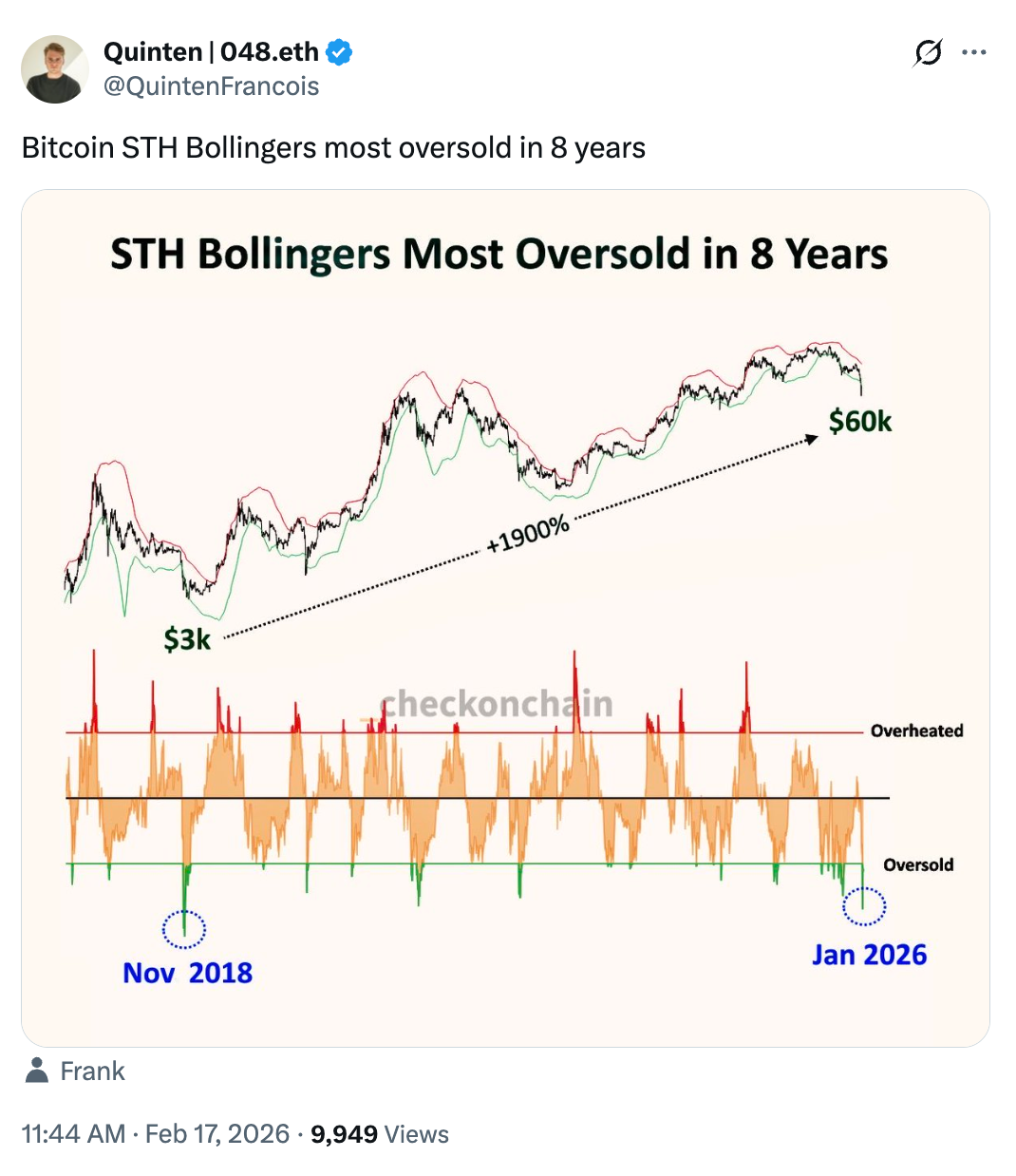

Bitcoin is mirroring 1,900% rally setup from 2018

Bitcoin’s short-term holder stress has dropped to its lowest level since the 2018 bear market bottom, according to new on-chain data from Checkonchain.

The Short-Term Holder (STH) Bollinger Band metric shows the oscillator falling into its deepest oversold territory in nearly eight years.

The indicator applies Bollinger Bands to the gap between Bitcoin’s spot price and the average cost basis of short-term holders, defined as wallets holding BTC for less than 155 days.

When the oscillator pierces the lower statistical band, it signals that Bitcoin is trading significantly below what recent buyers paid, beyond normal historical volatility. Historically, this signal has aligned with macro bottoms.

For instance, a similar oversold print appeared in late 2018 and preceded a roughly 150% rally within a year and 1,900% BTC price increase in three years.

It also flashed ahead of the November 2022 bottom, which preceded a 700% rally to a record high near $126,270.

Additionally, realized losses among short-term holder whales have stayed muted since Bitcoin’s October 2025 peak near $126,000, suggesting larger recent buyers haven’t capitulated yet.

Related: Traders pinpoint three price targets for Bitcoin if $70K holds as resistance

These metrics hint at seller exhaustion, aligning with the bottom outlook of multiple analysts, including those at crypto custodian platform MatrixPort.

Bitcoin may rebound by the end of March

Wells Fargo also sees a near-term liquidity tailwind building for Bitcoin.

In a note cited by CNBC, Wells Fargo strategist Ohsung Kwon said larger-than-usual US tax refunds in 2026 could revive the so-called “YOLO” trade, with as much as $150 billion potentially flowing into equities and Bitcoin by the end of March.

Such an event could absorb remaining sell pressure, reinforcing the idea that Bitcoin may bottom in the coming weeks.

Dieser Artikel enthält keine Anlageberatung oder -empfehlungen. Jede Investitions- und Handelsmaßnahme birgt Risiken, und Leser sollten bei ihrer Entscheidung eigene Recherchen durchführen. Obwohl wir bestrebt sind, genaue und aktuelle Informationen bereitzustellen, übernimmt Cointelegraph keine Garantie für die Richtigkeit, Vollständigkeit oder Zuverlässigkeit der Informationen in diesem Artikel. Dieser Artikel kann zukunftsgerichtete Aussagen enthalten, die Risiken und Unsicherheiten unterliegen. Cointelegraph haftet nicht für Verluste oder Schäden, die sich aus Ihrem Vertrauen auf diese Informationen ergeben.