Die bisherige Performance von Bitcoin ergab eine Wahrscheinlichkeit von 88 %, dass die Preise bis Anfang 2027 steigen werden, was die jüngste einer Reihe neuer bullischer BTC-Preisprognosen ist.

Bitcoin (BTC) at $122,000 in ten months could be an “average return” if history repeats itself.

Key points:

-

An “informal” Bitcoin price metric gives 88% odds of BTC/USD trading higher by early 2027.

-

$122,000 per coin would mark an “average return” based on prior performance.

-

Bullish BTC price predictions remain in place despite the current low sentiment.

BTC price ended half of past 24 months higher

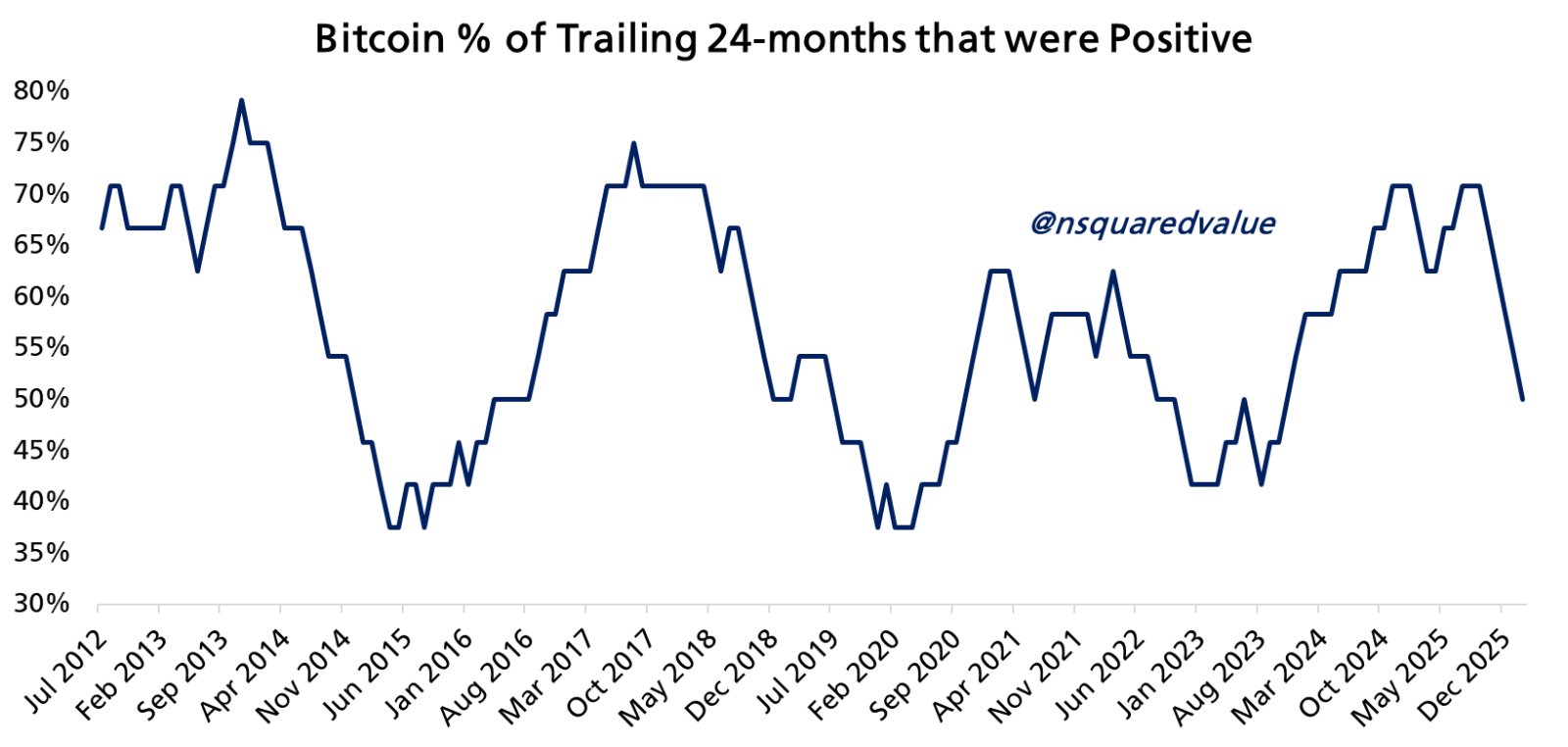

New analysis from network economist Timothy Peterson gives almost 90% odds of a BTC price being higher by early 2027.

Bitcoin’s underperformance since Q4 2025 has not removed every bullish BTC price prediction that leverages historical data.

For Peterson, monthly price action over the past two years points to a recovery through the rest of the year.

“50% of the past 24 months have been positive. This implies a 88% chance that Bitcoin will be higher 10 months from now,” he reported on X.

“The average return is exp(60%)-1 = 82% => $122,000. Data goes back to 2011.”

In a previous post, Peterson acknowledged that trailing price performance is more useful for identifying trend “inflection points” than price targets.

“This metric measures frequency, not magnitude. So Bitcoin could trend sideways for months and this metric could still go down. But it is still very useful for identifying inflection points,” he wrote, calling the tool “informal.”

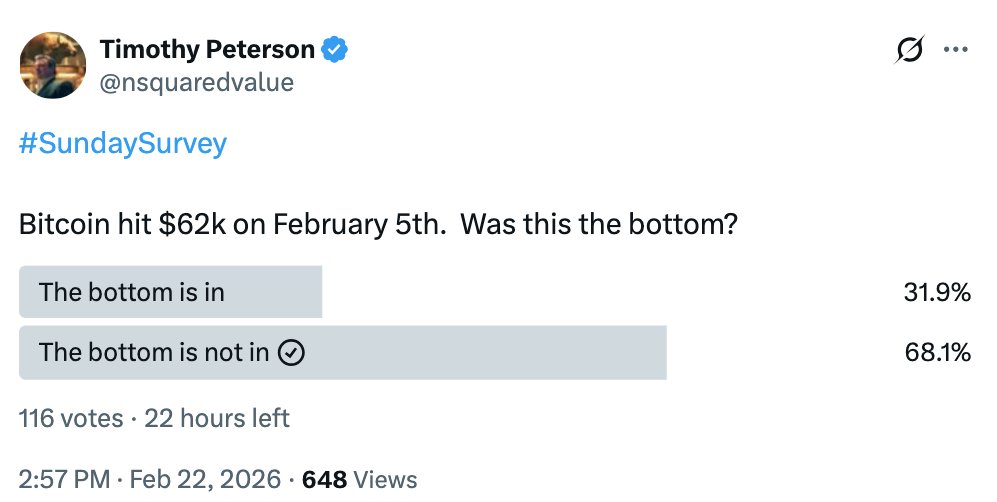

A survey conducted by Peterson on Sunday, meanwhile, underscored existing bearish crypto market sentiment.

Bitcoin bulls double down

As Cointelegraph reported, other market sources continue to beat on a major BTC price recovery in 2026.

Related: Bitcoin whales participate in V-shaped accumulation, offsetting 230K BTC sell-off

Among them is an analysis from Bernstein, which this month offered a $150,000 target, calling Bitcoin’s comedown its “weakest bear case” in history.

US banking giant Wells Fargo additionally sees $150 billion in capital inflows into Bitcoin and stocks by the end of March.

“Speculation picks up with bigger savings…we expect YOLO to return,” analyst Ohsung Kwon wrote in a note last week.

Dieser Artikel enthält keine Anlageberatung oder -empfehlungen. Jede Anlage- und Handelsmaßnahme birgt Risiken, und Leser sollten bei ihrer Entscheidung eigene Recherchen durchführen. Obwohl wir bestrebt sind, genaue und aktuelle Informationen bereitzustellen, übernimmt Cointelegraph keine Garantie für die Richtigkeit, Vollständigkeit oder Zuverlässigkeit der Informationen in diesem Artikel. Dieser Artikel kann zukunftsgerichtete Aussagen enthalten, die Risiken und Unsicherheiten unterliegen. Cointelegraph haftet nicht für Verluste oder Schäden, die sich aus Ihrem Vertrauen auf diese Informationen ergeben.